Zone pour le texte affichée dans le sous menu, ce texte ne sera pas visible une fois déconnecté :

African insurance company

CRM for insurance companies in Africa: complete digital solution

As an insurance company operating in Africa, are you equipped to meet the modern challenges of digital transformation and effective customer management? Using an obsolete system slows your productivity, creates major operational overloads for your teams and generates confusion for your policyholders and intermediaries. SKY CRM / ERP, 100% digital insurance software, is specifically designed to support the growth ambitions of African insurers and optimise all your insurance operations.

Our CRM / ERP for insurance integrates seamlessly with your existing systems through secure APIs and standardised EDI flows, allowing you to keep your business processes and technology investments while benefiting from modern, high‑performance features specifically tailored to the African insurance sector. Developed with 40 years of expertise, our software for insurers meets the specific requirements of the African market: CIMA compliance, multi‑currency and multi‑language management, and local regulatory compliance.

Advanced features for African insurance companies

The SKY solution is designed to provide African insurance companies with a tailored insurance broker CRM capable of meeting the specific requirements of the continental market while simplifying your teams’ day‑to‑day operations. Thanks to its advanced features and an intuitive interface based on the globally recognised ODOO platform, SKY radically transforms the management of your business and significantly improves your operational efficiency.

Automated pricing and quote management: Our insurance software lets you quickly configure a new insurance product for a prospect and instantly generate a personalised quote thanks to the integrated pricing API. The configurable calculation engine takes into account your pricing scales, risk coefficients, loadings and specific commercial conditions. This automation significantly reduces response times for prospects and improves your conversion rate.

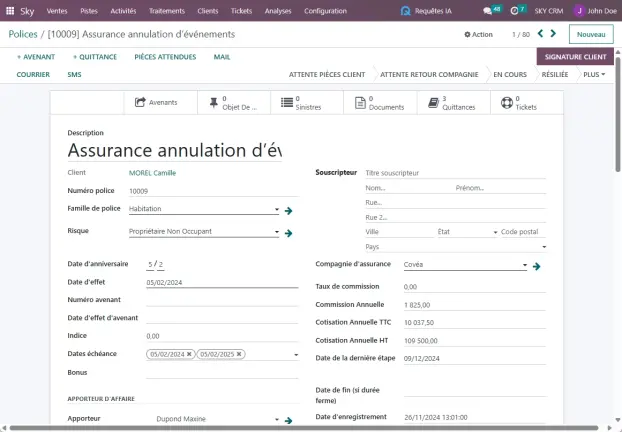

Full policy management and digital underwriting: Easily and automatically transfer new policy data from SKY to your core system via API, whether for new or existing clients. Our insurance CRM manages the entire policy lifecycle: issuance, endorsements, suspensions, cancellations, renewals and full change history. Paperless processes speed up your operations and reduce data entry errors.

360° customer view and data centralisation: Instantly access all consolidated customer information: complete administrative data, portfolio of active and historical policies, claim notifications and tracking with real‑time status, issued premium notices and payments, and logged communications and interactions. This data is synchronised daily via EDI interfaces with your production systems, ensuring perfect information consistency.

Assignment of sales opportunities and sales management: Our insurance broker software automatically assigns cross‑sell or up‑sell opportunities to existing clients according to configurable business rules. Your sales teams benefit from efficient pipeline tracking with automatic alerts on critical deadlines, optimising your growth strategy.

Artificial intelligence, extranet and African regulatory compliance

Personalised multichannel customer communication: Engage your policyholders and intermediary networks with targeted, personalised email/SMS marketing campaigns, sent individually or in bulk according to your customer segments. Our insurance CRM includes customisable templates and a tracking system to measure the effectiveness of your communications.

Secure extranet for policyholders and intermediaries: Offer your end customers and distribution network 24/7 online access where they can view their policies in real time, download insurance certificates, manage their risks (motor fleets, property, etc.), check the status of their claims, download all contractual documents and submit new claims directly online. This digital self‑service dramatically improves the customer experience while reducing the workload of your call centres.

Dynamic dashboards and strategic management: Benefit from analytical reports and built‑in dashboards perfectly aligned with key performance indicators for the African insurance sector: production by line of business and distribution channel, customer retention rate, real‑time loss ratio (L/R), profitability analysis by product and segment, and tracking of collections and cash flow. These management tools give you a strategic overview to support informed decision‑making.

Integrated artificial intelligence: Our insurance software includes next‑generation AI features. The intelligent search tool in the document management system allows your teams to query thousands of documents in natural language: “What are the cancellation terms for product X?” or “What is the commission rate for brokers on motor business?”. The AI query assistant automatically generates your complex reports: “Production by branch this quarter” or “Change in the L/R ratio by line of business over 12 months”. Build your own customised dashboards simply by conversing with your intelligent assistant.

Regulatory compliance and complaints management: SKY rigorously complies with international (SLA, GDPR) and African (CIMA for the 14 member countries, ARCA for DRC) standards. Our insurance broker CRM includes a complete complaints management system with automated tracking of regulatory processing times, as well as real‑time compliance checks to keep you aligned with local and international regulations. The system automatically generates all mandatory regulatory reports, ensuring ongoing compliance during audits by supervisory authorities.

With SKY CRM, you have a technology partner that understands the specific challenges of African insurance companies and supports you in your digital transformation.