Zone pour le texte affichée dans le sous menu, ce texte ne sera pas visible une fois déconnecté :

Insurance broker in Africa

CRM for insurance brokers in Africa: CIMA and ARCA zone solution

As a mid-sized or large insurance broker operating in Africa, whether you work in the CIMA zone or in other regions of the continent, your business requires insurance broker software adapted to the complex realities of African markets. SKY CRM / ERP fully understands the regulatory, accounting and operational specificities of your profession and supports you in the strategic development of your brokerage.

Our insurance CRM is specifically designed to meet the requirements of African managing brokers who handle large portfolios, complex group policies and delegated management. Developed with 40 years of expertise in the insurance sector, our insurance software natively integrates the specific features of the African market: predominance of property and casualty insurance, significant weight of compulsory motor insurance, multi‑currency and multi‑language management, compliance with

CIMA and ARCA standards, and enhanced traceability of all your operations. Built on the globally recognised ODOO platform, SKY CRM / ERP combines technical robustness, proven reliability and scalability to support the growth of your business in an African market undergoing rapid digital transformation.

Accounting management adapted to African specificities

Managing your insurance brokerage business in Africa involves unique accounting and tax specificities that vary from one country to another. Our insurance broker software is designed to take into account all your operational needs in financial management: accurate tracking of receipts in multiple local currencies (CFA franc, Congolese franc, Moroccan dirham, Naira, etc.), invoicing in line with the tax rules of your country of operation, full traceability of commission remittances by insurer and by product, management of payment terms specific to the African context, and rigorous tracking of introducers.

With our insurance broker software, you efficiently manage all the key processes of your large‑account activity: analytical breakdown of premium notices by coverage for a clear view of profitability, sophisticated management of group policies (motor fleets, group insurance), processing of claims payments with detailed breakdown, tracking of non‑entrusted items and accounting export to your general ledger software. This financial granularity allows you to steer your brokerage precisely and optimise your profitability by line of business.

Our insurance software also takes into account the specific characteristics of African markets. The financial reporting module generates all the management statements needed to steer your activity: production dashboards, commission analyses, profitability tracking by customer segment. This global and detailed view gives you all the tools you need to make informed strategic decisions and develop your business with confidence on the African market.

CIMA / ARCA compliance and dedicated local support in Abidjan

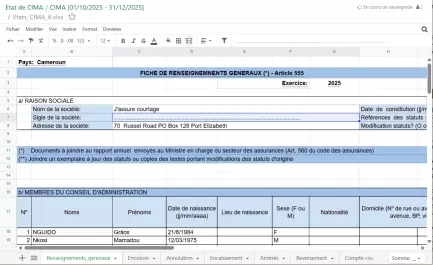

Regulatory compliance is a major challenge for African brokers, particularly as supervisory authorities progressively tighten their controls. Our insurance CRM includes a report generator that complies with CIMA (Conférence Interafricaine des Marchés d’Assurance) standards for the 14 member countries: Benin, Burkina Faso, Cameroon, Central African Republic, Congo, Côte d’Ivoire, Gabon, Guinea‑Bissau, Equatorial Guinea, Mali, Niger, Senegal, Chad and Togo.

For brokers operating in the Democratic Republic of Congo, our insurance broker software also produces regulatory reports that comply with ARCA (Autorité de Régulation et de Contrôle des Assurances) requirements. You automatically generate all mandatory reports: quarterly and annual statements, production declarations, tracking of receipts, breakdown by line of business and complete regulatory reporting. This native compliance allows you to easily meet the requirements in force in your region without complex handling or risk of error during audits.

We have deployed a dedicated technical and functional support team based in Abidjan, Côte d’Ivoire, to offer you local assistance perfectly adapted to the African context. Our local experts understand your daily challenges, speak your language and master the regulatory and operational specificities of your market. This local presence guarantees personalised, responsive and efficient support, with interventions possible in your time zone. Our team supports you at every stage: initial training of your teams, customised configuration according to your business processes, ongoing technical assistance and advice to optimise the use of your insurance broker CRM.

Our insurance software includes next‑generation artificial intelligence features to optimise your productivity. The intelligent search tool within the document management system lets you query your thousands of documents in natural language: “What is the annual premium amount for contract X?” or “Which deductible applies to client Y?”. The AI query assistant automatically generates your complex reports: “Amount of commissions by company this quarter” or “Production by product family with year‑on‑year changes”. Drawing on our proven experience in deploying solutions for African brokers and our in‑depth knowledge of the continental context, we work closely with our clients to understand their specific challenges and provide concrete solutions adapted to their operational realities.